For many potential homeowners exploring affordable financing options, understanding the nuances of various loan programs is crucial. One such option is the USDA Direct Loan, known for its remarkably low interest rates compared to standard market rates. Many ask, ‘What is the USDA direct loan interest rate?’ In this update for July 2024, we’ll explore the current rates and the factors behind them.

What is the USDA direct loan interest rate?

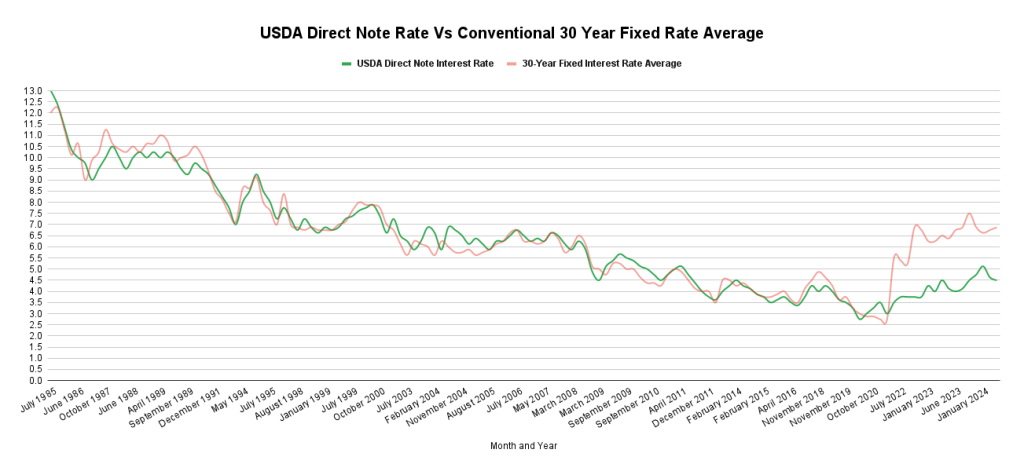

As of July 1st 2024, while the average market rates for mortgages hover around the low 7% range, the USDA Direct Loan offers a significantly lower rate at 4.875%. This post will go into why USDA Direct Loans offer such competitive rates and how they benefit eligible rural homebuyers.

What Makes USDA Direct Loan Interest Rates So Low?

The USDA Direct Loan program, also referred to as the Section 502 Direct Loan Program, is tailored specifically to assist low-income and very low-income individuals and families in purchasing, building, renovating, or relocating homes in eligible rural areas. Here’s a breakdown of why these loans come with lower interest rates:

Government Subsidy: The federal government subsidizes the USDA Direct Loan program, allowing it to offer below-market interest rates. This initiative makes homeownership more accessible and affordable for qualified applicants.

Public Policy Objective: Lowering interest rates serves a broader public policy goal aimed at promoting rural development and increasing homeownership in less densely populated areas. Affordable financing draws more residents to these areas, potentially boosting local economies.

Income-Based Assistance: The program includes a payment assistance feature, which is a subsidy that temporarily reduces the mortgage payment. This adjustment is based on the borrower’s adjusted income, and can significantly decrease the interest rate paid by the homeowner, enhancing affordability.

Long-Term Stability: The USDA’s approach supports not only initial affordability but also long-term stability for homeowners, helping to maintain vibrant, stable rural communities.

Historical Perspective on USDA Direct Loan Rates

The Section 502 Direct Loan program’s interest rates can potentially drop as low as 1%, depending on the borrower’s eligibility for payment assistance. This unique feature adjusts the monthly payment to either 24% of the borrower’s income or the amount on the promissory note, whichever is lesser. Over the years, this rate has helped countless families achieve their dream of homeownership.

Here is a historical comparison of USDA Direct Loan rates versus traditional 30-year fixed mortgage rates:

Sources:

30-Year Fixed Rate Mortgage Average in the United States

Conclusion

The USDA Direct Loan program offers a lifeline to many who might otherwise find homeownership out of reach due to high conventional mortgage rates. By providing significantly lower rates and long-term support, the program not only fosters individual homeownership but also contributes to the vitality and growth of rural communities across the United States. For those eligible, a USDA Direct Loan is certainly an option worth considering for its notable financial benefits.