HomeDirection is not affiliated with the USDA or any government agency.

Section 502 of the Housing Act of 1949, authorized the use of federal funds to help low- and very low-income persons purchase decent, safe, sanitary, and structurally sound homes in rural areas all across America.

Managed by the United States Department of Agriculture (USDA), this Section 502 funding is given out in the form of a loan that is known as the Rural USDA Direct Loan.

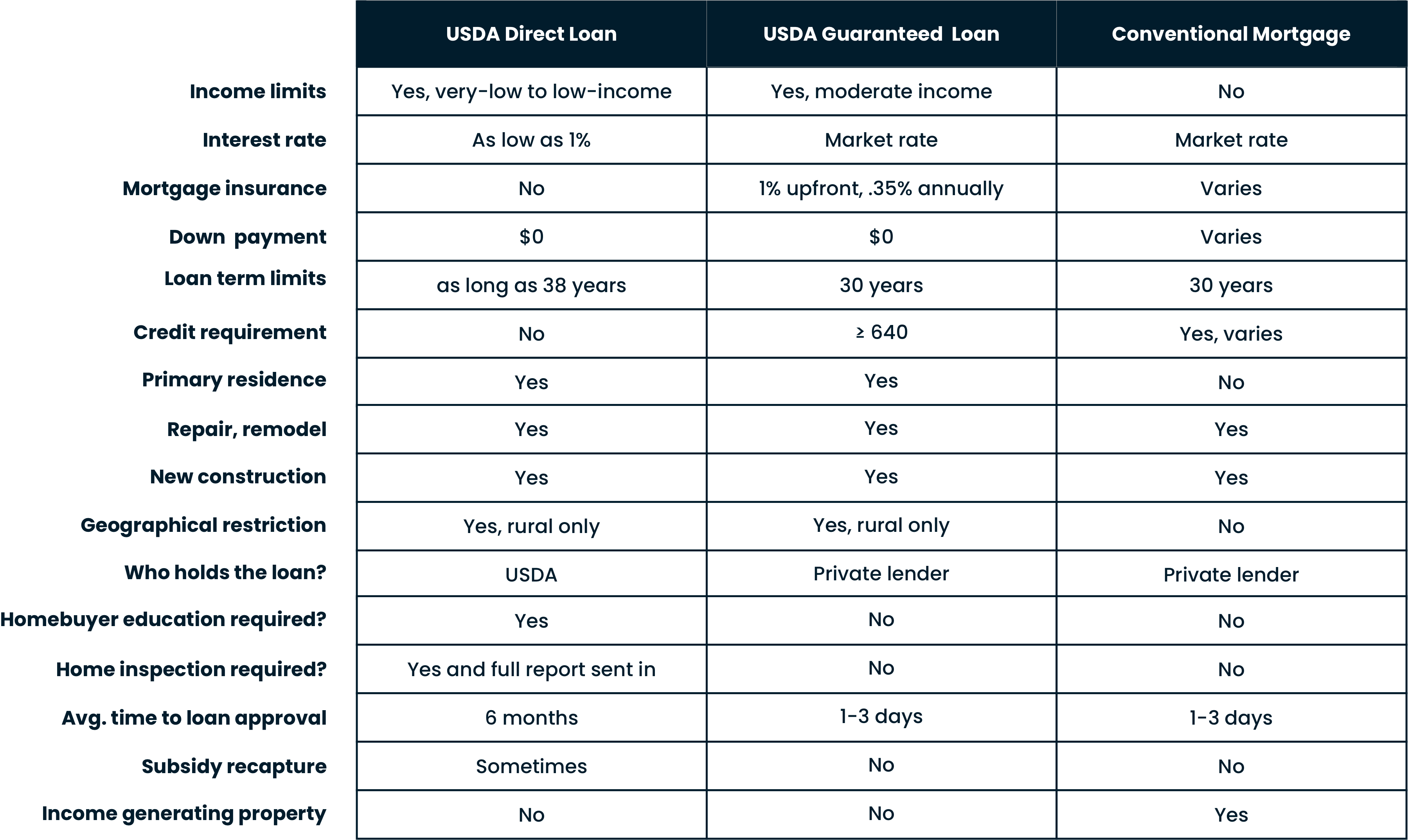

While this loan offers amazing benefits, it’s not for everyone. Use the information below to determine if it may be right for you. Reach out to us with questions.

Applicants must meet county income requirements (for example, $114k in King County, WA)

With payment assistance the monthly mortgage payment can be reduced to a low as an effective 1 percent interest rate.

Those with assets over $15k can be required to use a portion of those assets.

No mortgage insurance.

The USDA Direct Loan program is designed for low and very low-income borrowers, who cannot secure financing through traditional means. Are you a good fit? We can usually tell with a single conversation as we take a quick look at your income, household size, credit history, and a few other factors. From there you would put together your application and send it in to the USDA. If approved, they will issue you a Certificate of Eligibility letter, which lays out all the funding details and lending limit, and is usually good for 120 days.

While this is a nationwide program, funding is specifically set aside for rural properties (don’t worry, there’s plenty out there). Each county has their own borrowing limits and every property’s taxes, insurance, and other expenses are also taken into account.